Foreign Exchange Markets

Updated 3/27/2024 Jacob Reed

The foreign exchange market shows up most years in some form on the Advanced Placement exam. Drawing the graph isn’t too difficult since it looks like a typical supply and demand graph. But there are some differences you need to be aware of. Review it all below, then check your understanding with the review game.

Note: I will use the market US Dollars relative to Mexican Pesos as my example for simplicity, but these concepts apply equally to any two currencies.

Axes: The “y” axis on the foreign exchange market is the “Exchange rate in Pesos,” “Pesos per Dollar,” “Pesos/Dollars, or my preference, “Price of Dollars in Pesos.”

The “x” axis is the quantity of US Dollars.

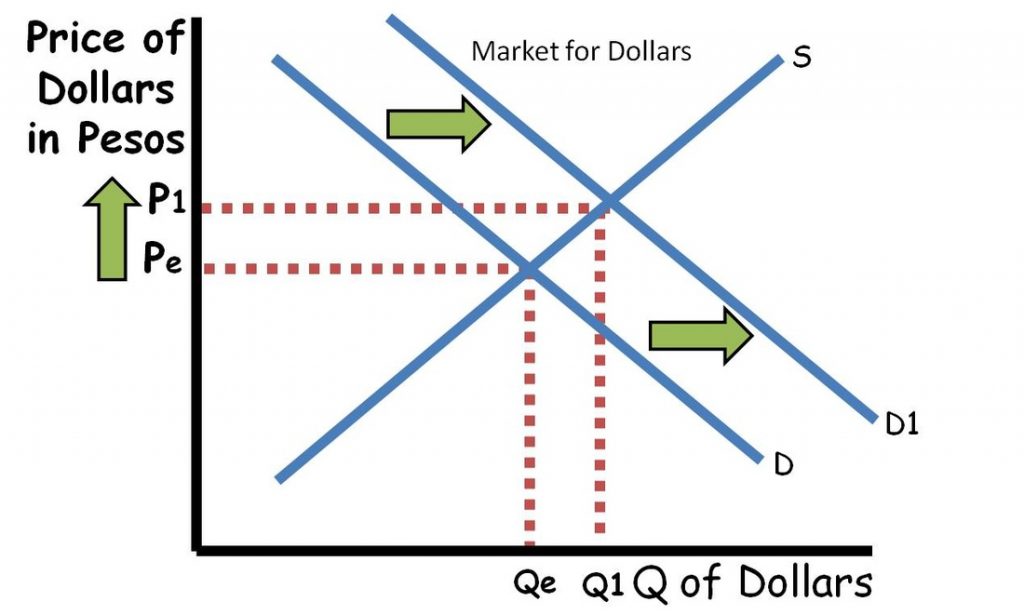

Just like every other market, where the two curves intersect you find the equilibrium price and equilibrium quantity. In this case, the price is called the exchange rate. When the exchange rate increases, the currency appreciates. When the exchange rate falls, the currency depreciates.

Determinants of Currency Demand: There are 3 determinants of demand for a currency (shifters). The first is the demand for a country’s exports. If the demand for a country’s exports increase, the demand for the currency also increases (causing the currency to appreciate). If demand for exports decrease, demand for the currency also decreases (causing the currency to depreciate). Some factors that influence the demand for a country’s exports include price levels (lower price levels, higher demand), foreign national income (more foreign income, more demand), and foreign consumers’ tastes and preferences.

The second determinant of demand is interest rates. These interest rate changes could come from the loanable funds market or the money market. If the US interest rate increases relative to Mexico, the demand for US dollars will increase as foreign investors purchase dollars to invest in the US seeking a higher rate of return. At the same time the demand of Mexican Pesos (in the market for pesos) will decrease as foreign investors will demand fewer pesos to invest in Mexico. This will cause the US dollar to appreciate while the Mexican Peso depreciates.

The third determinant of demand is the expected future exchange rates. Higher future exchange rates increase demand and lower expected future exchange rates decrease demand.

Determinants of Currency Supply: There are 3 determinants of supply for a currency (shifters). The first is the demand for imports within the country. When a country demands more imports, importers sell dollars to purchase the foreign currency needed to pay for the imports. Higher US demand for imports means a higher supply of US Dollars in the foreign exchange markets. Price levels, national income, and consumers’ tastes and preferences all impact a country’s demand for imports.

The second determinant of supply is interest rates. These interest rate changes could come from the loanable funds market or the money market. If the US interest rate decreases relative to Mexico’s interest rate, foreign investors will sell US dollars to purchase Mexican Pesos. This will increase the supply of US dollars. It will also decrease the supply of Mexican Pesos as people with Pesos will be less likely to sell them given the higher interest rates in Mexico.

The third determinant of supply is the expected future exchange rate. Higher expected future exchange rates decrease supply and lower expected future exchange rates increase supply.

How exchange rates impact Xn: Exchange rates have a big impact on a country’s imports and exports. When the US dollar appreciates, it’s exports become more expensive for foreign entities and imports get cheaper. When the US dollar depreciates, US exports get cheaper for foreign entities and imports get more expensive. As a result, a weak dollar increases net exports and strong dollar decreases net exports.

Special Notes about the foreign exchange markets: Currencies are closely linked in the foreign exchange markets. Every time someone exchanges dollars for pesos, they have simultaneously increased the supply of dollars and the demand for pesos. And every time someone exchanges pesos for dollars, they simultaneously increase the supply of pesos and the demand for dollars. When it comes to currencies one cannot be demanded without the other being supplied. As a result, when the US Dollar appreciates relative to the Mexican Peso, the Mexican Peso depreciates relative to the US Dollar (and vice versa).

Also, since the determinants for both curves are so similar, when the demand for a currency increases, the supply for that same currency generally decreases. Likewise when the demand for a currency decreases, the supply for that currency generally increases. These double shifts amplify the change in the exchange rate while making the equilibrium quantity indeterminate. This aspect can get a little complicated and the College Board has isolated shifts in the past. As a result, the game below only focuses on one shift at a time.

Up Next:

Review Game: Foreign Exchange Market Review Activity

Graph Drawing Practice: Foreign Exchange Markets

Content Review Page: Comparative Advantage

Outside Resource: Jason Welker