6/1/2020 Jacob Reed

What is the difference between the national deficit and the national debt?

A deficit exists when government spending is greater than taxes. A budget surplus exists when taxes are greater than government spending. Most years, the US government has had a budget deficit. You can see the US budget deficits and surpluses over time here.

The national debt is the accumulation of all previous budget deficits and surpluses. Since the US has had so many more budget deficits than surpluses, the national debt has grown substantially over time. You can see the current national debt here.

What changes the deficit?

Taxes: An increase in taxes will reduce the deficit and a decrease in taxes will increase the deficit.

Government Purchases: An increase in government purchases will increase the deficit, and a decrease in government purchases will decrease the deficit.

Transfer Payments: Increasing transfer payments (like unemployment and welfare payments), will increase the deficit, and decreasing transfer payments will decrease the deficit.

The Business Cycle: As you learned previously, automatic stabilizers impact the budget. When the economy expands, taxes increase and transfer payments decrease even without discretionary action by the president and congress. Those automatic changes decrease the budget deficit. On the flip side, a contracting economy decreases taxes and increases transfer payments, which leads to an increase in the budget deficit.

What is Crowding Out?

Crowding out is the downside of expansionary fiscal policy. It tells us that a government deficit (or surplus) impacts the loanable funds market and it can be tricky to illustrate because there are two ways to illustrate that budget impact on the graph.

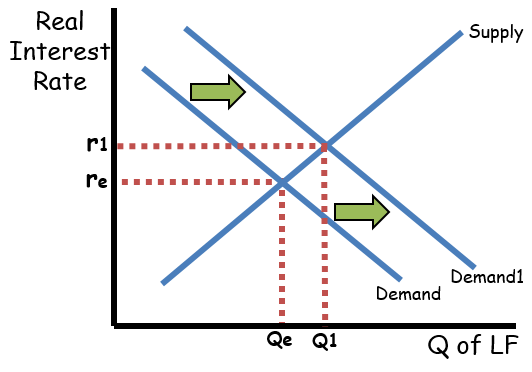

One way is to include a change in the budget on the loanable funds demand curve. When the government has a deficit, it demands more loans alongside private businesses; increasing the demand for loanable funds. When the government has a surplus, it demands fewer loans decreasing the demand for loanable funds. This method makes a lot of sense intuitively. But there is a downside. When the government deficit spends, it generally increases the real interest rate, reducing the quantity of investment (AKA Crowding Out). With this method, the change in equilibrium quantity does not correlate to a change in gross investment. That is, an increase in the budget deficit will increase the equilibrium quantity when it in fact decreases gross investment.

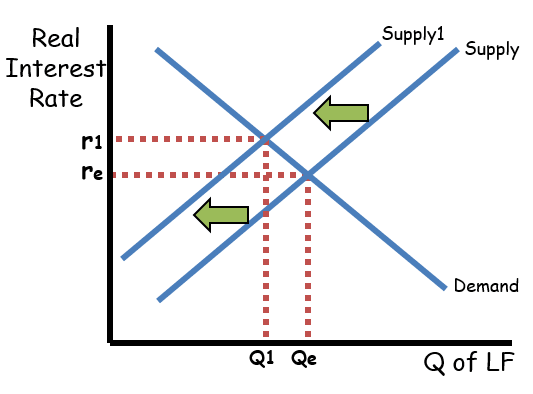

The other method for dealing with a change in the government’s budget is to shift the supply curve. The logic behind this method is when the government has a budget surplus, it has savings that add to the savings supply (shifting it to the right). When the government has a budget deficit, it has dis-savings which are subtracted from savings supply (shifting it to the left). In other words, a budget deficit means the government takes some of the savings supply so there is less available for private loans. While this method may be less intuitive, it has the benefit of showing the correct correlation between a change in equilibrium quantity of loanable funds and the change in gross investment. That is, an increase in the budget deficit will decrease the equilibrium quantity of loanable funds just as it decreases gross investment.

Either method for dealing with a government budget change is perfectly acceptable. I suggest you use the one taught by your teacher or college professor.