Bank Balance Sheets

Updated Jacob Reed 8/10/2023

Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. Below you will find a rundown of everything you need to know about bank balance sheets.

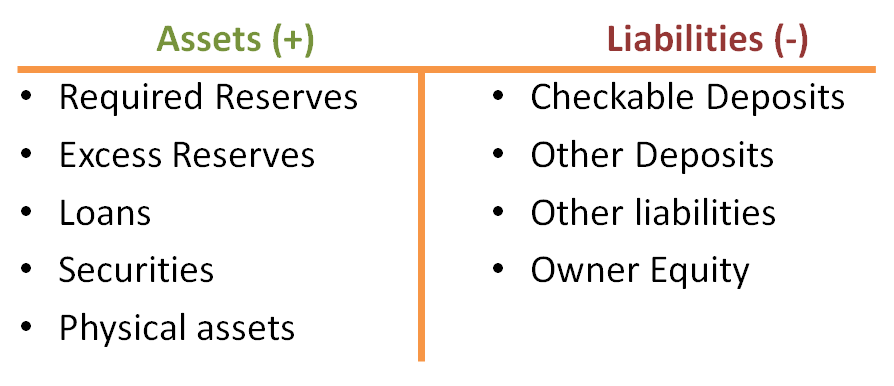

1. What are the two columns on a bank balance sheet?

On the left side of a bank balance sheet, you will find the bank’s assets. Assets are all of the things the bank owns that are of value. They include required reserves (a percentage of demand deposits set by the central bank that cannot be loaned out), the excess reserves (funds available to be loaned out), loans (IOU’s from customers), securities (also called bonds), and physical assets (the building, computers, desks, etc).

On the right side of the bank balance sheet, are the liabilities. These are all the things the bank owes. They are essentially a bank’s debts. They include demand deposits (checkable deposits owed to customers), other deposits (savings accounts, etc. owed to customers), other liabilities (debts, etc. owed by the bank), and owner equity (profit owed to bank’s owners).

On a bank balance sheet, assets always equal liabilities (they balance). If there is an increase in liabilities, there must be a decrease in a different part of liabilities, an increase in assets, or some combination of both.

2. What changes a bank’s balance sheet assets?

Reserves come from the money deposited by a bank’s customers. This is money that has not been loaned out. There are two types of reserves. Required reserves are a percentage of checkable deposits (checking account deposits) set by the central bank’s (the Federal Reserve in the US) reserve requirement. Excess reserves is the amount of total reserves the bank can loan out. Required reserves plus excess reserves equals total reserves (sometimes just called reserves).

If the reserve requirement is 10%, and a customer deposits $1000 in their checking account, $100 (10%) will be required reserves and $900 will be excess reserves that can be loaned out. Total reserves for the bank will now be $1000. If the money was deposited in a savings account instead, all $1000 would go to excess reserves. That is because there is no reserve requirement on savings deposits.

Excess reserves will also increase when loans are paid back to the bank, securities are sold, physical assets are sold, or any of the liabilities are increased.

Required reserves only change when there is a change in the amount of demand deposits (checkable deposits). They always equal a percentage (set by the central bank’s reserve requirement) of checkable deposits.

Excess reserves will decrease whenever loans are made, securities are purchased, physical assets are purchased, or any of the liabilities are decreased.

Note: It is the excess reserves that is used with the money multiplier to calculate the creation of new money, loans, and deposits.

Note: Reserves are not counted in the M1 or M2 money supply.

Loans are IOU’s to the bank. They are on the assets side of the balance sheet because these promises to pay are worth the amount of the loan.

When the bank loans money to a customer, it will reduce excess reserves and increase loans. When a customer pays back a loan, it will increase excess reserves and decrease loans.

Securities (bonds) are pieces of paper which signify the right to be paid back for a loan. Securities are essentially loans to a business or the government.

When a bank purchases securities, excess reserves will decrease and securities will increase. When a bank sells securities, excess reserves will increase and securities will decrease.

Note: If the central bank buys bonds from a bank, the money supply does not immediately increase as reserves are not counted in the M1 or M2 money supply.

Physical Assets include the bank building, desks, chairs, computers, and even those pens with the chain attached. These are the physical objects (capital) the bank owns.

If the bank buys more physical assets, excess reserves will decrease as physical assets increase. If the bank sells physical assets, excess reserves will increase as physical assets decrease.

3. What changes a bank’s balance sheet liabilities?

Checkable Deposits are checking account deposits. These go up and down when a bank’s customers deposit or withdraw money to or from their checking accounts. It is a percentage of these checkable deposits (set by the central bank’s reserve requirement) that comprise the required reserves.

Other Deposits (sometimes listed as “savings deposits”) are deposits from customers that go into non-checking accounts. If a customer makes a deposit into their savings account, other deposits will increase (excess reserves will also increase).

Note: There are no required reserves on other deposits.

Other Liabilities include loans and other debts owed by the bank. These must not be confused with loans found on the assets side of the balance sheet which are loans owed to the bank. If the bank takes out a loan, it will increase other liabilities and increase excess reserves.

Owner Equity is money (profit) owed to the owners (or shareholders) of the bank. If the bank collects interest when loans are repaid, that interest is added to owner equity as well as excess reserves on the assets side.

Is your head spinning yet? There are lots of components to a bank balance sheet and it can be a little tricky to figure out what causes each component to increase or decrease. If you are ready to practice it all, head over to the bank balance sheet game and see how well you understand.

4. What is the money multiplier?

The actions of the central bank have a small immediate impact on bank reserves but that effect multiplies throughout the banking system. Money is created every time a loan is made and money is destroyed every time a loan is paid back. The money multiplier tells us how much new money, loans, or deposits can be created by increasing a bank’s reserves.

When a deposit is made in a bank, some of that money is loaned out (excess reserves) and some of it stays with the bank (required reserves). If the central bank has a Reserve Requirement of 10% and a customer makes a demand deposit of $1000, the bank can loan out $900 worth of excess reserves while keeping $100 in required reserves. The $900 loan (newly created money) can be deposited in a checking account. Now the bank can loan out $810 while $90 is kept in reserves. When that loan is redeposited, $729 can be loaned out while $81 is kept in reserves. As this process of loaning and redepositing continues, each loan is newly created money.

The formula for the money multiplier:

- Multiplier is 1 divided by the reserve requirement (1/RR)

Formula for the expansion of money:

- Maximum Loan, Deposit, or Money Creation = Excess Reserves x Money Multiplier

A 10% reserve requirement would mean the multiplier is 10 (1/.10 = 10). To find the maximum amount of money the banking system can create from the original $1000 deposit (from the example above), multiply the money multiplier times the excess reserves. That original deposit can cause the creation of $9000 ($900 of excess reserves times the money multiplier of 10) worth of new money. Since the new money is all created through loans and the original deposit was not a loan, $9000 is also the amount of loan creation the banking system could create.

To figure out how many dollars’ worth of demand deposits this $1000 deposit could create, again multiply the excess reserves by the multiplier to get $9000 worth of deposits. Since the original $1000 was also a deposit, it must be added in; bringing the total deposit creation to $10,000.

If, instead of a customer deposit, the central bank bought $1000 worth of bonds from a bond dealer (on the open market), things would work a little differently. The bond dealer will deposit the newly created money into their bank account and the excess reserves can be loaned out. The maximum dollar value of loans would be $9000 ($900 of excess reserves times the money multiplier of 10). Since the original bond purchase was new money (the central bank creates new money when they buy bonds) and was fully deposited by the bond dealer, to find the maximum money creation or deposit creation you would need to add the original bond purchase to the $9000 of loans. As a result, the maximum money creation and deposit creation from the central bank’s purchase would be $10,000.

The trick for all questions like this is to remember that money, loan, and deposit creation can be figured out by multiplying the excess reserves by the money multiplier. Then, look at the original amount and determine if it should be added in as well.

Note: This all works in reverse too. Actions of the central bank can shrink the money supply as well.

5. Why will the actual amount of money creation be less than the money multiplier predicts?

The money multiplier is about maximum changes in the banking system. It assumes banks always loan out excess reserves, money is always redeposited into a bank, and consumers do not hold cash. Since those assumptions are far from the reality, the actual changes in the banking system will be much less than the money multiplier indicates.

***Note: In the United States, the Federal Reserve (the US central bank) now uses an Ample Reserves System and currently has a 0% reserve requirement. You still need to know the above information for your AP exams, but this is less relevant to the US economy today

Up Next:

Review Game: Bank Balance Sheet Review Activity

Content Review Page: Monetary Tools