4 Things to Know About Economic Growth Before Test Day

Updated 7/11/2022 Jacob Reed

Economic growth is a concept that often causes my students a bit of trouble. Most of that trouble comes from misunderstanding the definition of economic growth in macroeconomics. Below you will learn everything you need to know about economic growth to make sure you ace your next macroeconomics exam. This content review covers topic 5.6 of the AP Macroeconomics Course Description (CED).

1. What is economic growth?

Many students think economic growth is an increase in Gross Domestic Product (GDP). That misconception is certainly reasonable; media outlets often report increases in GDP as economic growth after all. When GDP is divided by the population, we get per capita GDP. More per capita GDP means lower unemployment and a greater average standard of living for citizens in an economy. But merely increasing GDP or per capita GDP in the short run does not equate to true economic growth.

Economic growth is actually an increase in POTENTIAL GDP (or per capita potential GDP). When there is a sustained, long term increase in GDP, it is an indication of an increase in Potential GDP. As you learned with the business cycle and AS/AD model, when GDP is temporarily greater than potential GDP, the economy has an inflationary gap. When GDP is less than potential GDP, the economy has a recessionary gap.

Below you can see the difference between the United States’ potential real GDP (red) and the actual real GDP (blue).

2. What Causes Economic Growth?

Generally, economic growth comes from an increase in the quantity or quality of productive resources (land, labor, and capital). Increasing the amount of land, labor, or capital increases the quantity of goods and services an economy can produce. When the quality of resources increases instead of the quantity, the productivity of those resources increases. Productivity is one of the most important ingredients to economic growth as it leads to greater output without any additional resources.

Labor productivity is the quantity of goods and services each worker produces per hour of work (on average). Mathematically, productivity is found by dividing real GDP by the number of hours worked.

Labor productivity can rise when new technologies are developed, there are greater quantities of physical capital, or when there is (perhaps most importantly) an increase in human capital. Human capital is the skills and knowledge of workers. The more skills and knowledge workers have, the more productive they will be. Education, literacy rates, jobs training programs, etc. will all increase labor productivity and with that, economic growth.

Physical capital formation also has a large impact on economic growth (and labor productivity). When a country has more physical capital per worker, each worker will be able to produce more output per hour (on average). When the government enacts policies to encourage investment in physical capital, or when interest rates fall (in the loanable funds market or money market), businesses purchase more physical capital (gross investment), and the rate of economic growth increases.

While each year businesses purchase new physical capital, some old capital breaks or becomes obsolete. The loss of old physical capital is called depreciation. Gross investment (Ig) minus depreciation is called net investment (In). When net investment is positive, an economy has economic growth. When net investment is negative, obsolete capital is not being fully replaced, the capital stock of the economy decreases, and the economy shrinks (shifting the PPC inward and the LRAS left).

Note: An increase in the labor force will not increase productivity because it increases the number of workers, not the amount of output per hour worked.

3. What is the aggregate production function?

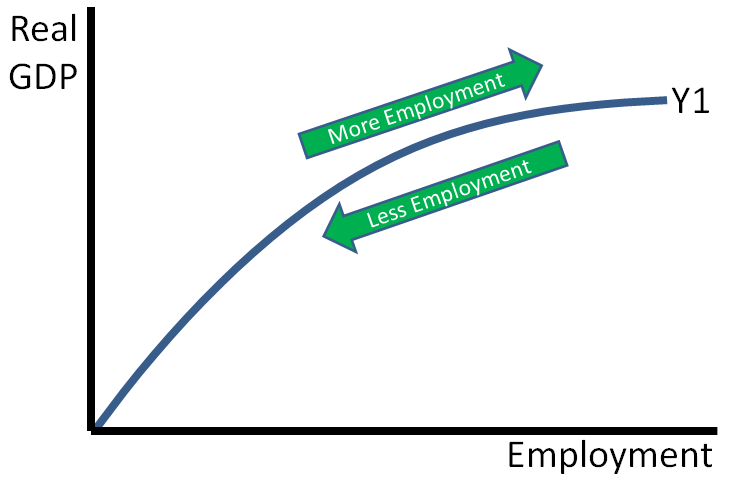

The aggregate production function is another graph model of the economy. This model shows the relationship between real GDP (on the Y axis) and an economy’s utilization of primary resources. The production function illustrated here focuses on a country’s employment (the utilization of a country’s labor). As more workers are employed, we see movement up the curve and real GDP increases (at a decreasing rate). As fewer workers are employed, we move down the curve and GDP decreases.

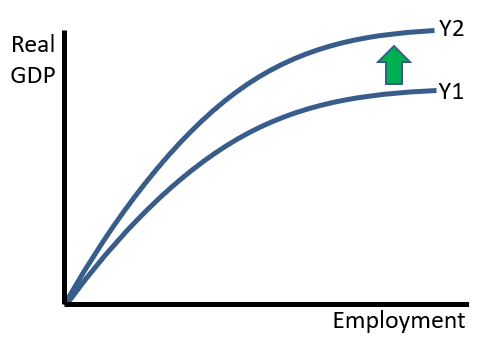

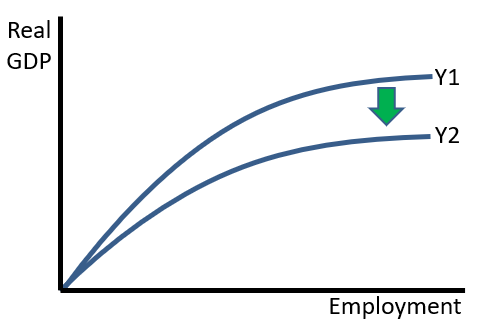

Anything that would cause an increase in the productivity of workers (improved technology and increases in human capital) or an increase in the quantity of other resources (other than labor) will shift this aggregate production function upward, while anything that would decrease the productivity of workers will shift it downward.

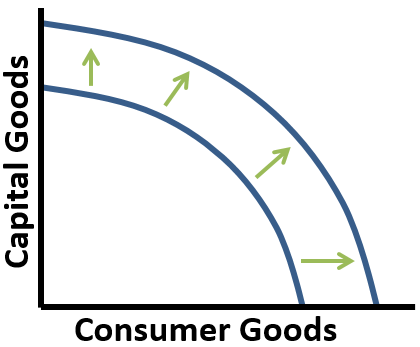

4. How is economic growth illustrated on the Production Possibilities Curve and AS/AD model?

The production possibilities curve shows the maximum possible production for an economy (all combinations of two goods or categories of goods). During a recession, an economy will produce at a point within the curve as resources sit idle. As the economy reaches long run equilibrium, production will move to a point on the curve. That movement from within the curve to on the curve is not economic growth. Since economic growth is an increase in potential GDP, it is illustrated as an outward shift of the PPC. An increase in the quantity or quality (productivity, technology, human capital) of resources will cause an increase in the possible production of both types of goods.

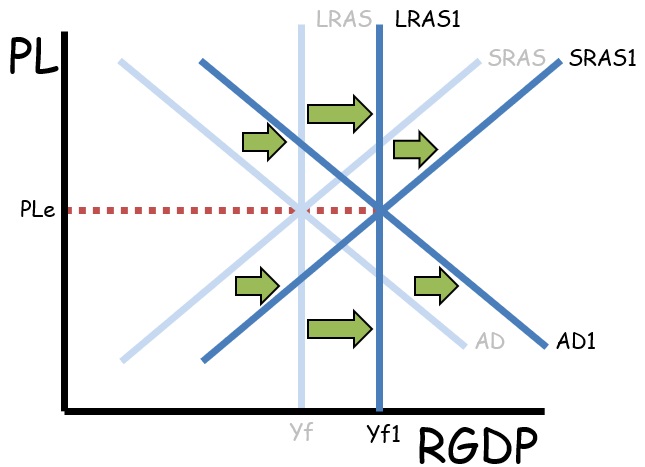

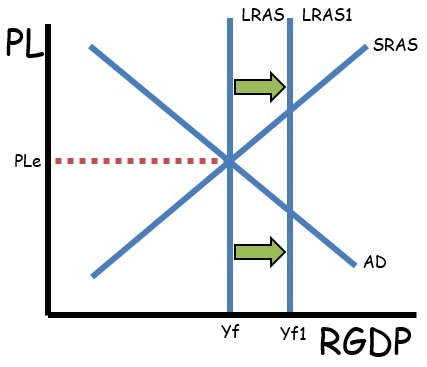

In the Aggregate Supply/Aggregate Demand model (AS/AD), the long run aggregate supply curve (LRAS) is vertical at the full employment output. Increases in the quality or quantity of resources means there can be more produced at full employment. So, economic growth is illustrated as a rightward shift of the LRAS in the AS/AD model.

In short, anything that shifts the LRAS to the right will also shift the PPC outward. Anything that shifts the LRAS left will also shift the PPC inward.

5. How can supply side policies impact economic growth?

While somewhat controversial, Government policies can have an impact on economic growth and productivity. Policies which help transition citizens into the workforce will increase the labor force participation rate and a larger workforce means more economic output.

The government can also enact policies which increase productivity and technology. Funding research and development can lead to the development of new, more efficient technologies. Funding jobs training programs can increase the labor force participation rate, and improve human capital (which increases productivity).

The government can also encourage economic growth through corporate (business) tax cuts, reducing regulations on business, and tax incentives for investment.

All of these supply side policies shift the aggregate demand (G and Ig increase), short run aggregate supply, and long run aggregate supply to the right.