Navigating Long-Run Adjustments in the AS-AD Model

4/23/2024 Jacob Reed

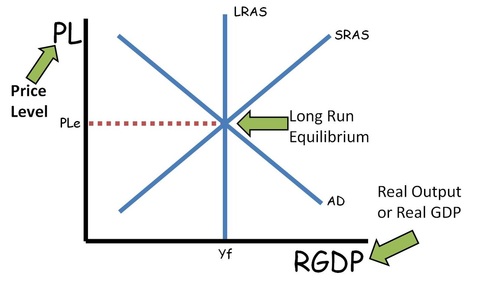

Previously, you learned that the long-run aggregate supply curve is vertical at the full employment level of real GDP. That is because, in the long run, at any price level, the economy will have the natural rate of unemployment and produce the quantity of goods and services associated with the natural rate of unemployment. You also learned that long-run equilibrium occurs when all curves in the AS/AD model (AD, SRAS, and LRAS) intersect. When that happens, the current level of output equals the full employment level of output, and the unemployment rate will equal the natural rate. Below you will learn how the economy makes these long-run changes.

Short-run vs Long-run

On the pages about aggregate supply, you learned that in the short-run wages are sticky, but in the long-run they are flexible. That is why we have an upward sloping aggregate supply curve in the short run, but a vertical aggregate supply curve in the long run. As a result, the difference between long and short run isn’t about a specific amount of time, rather, it is about what has changed. If wages (and other resources prices) have fully adjusted to the current economic conditions (price level, or an output gap), then the economy is in the long run. If not, the economy is still in the short run.

From a Short-run Recessionary Gap to Long-run Equilibrium:

When the intersection of the AD and SRAS curve results in a current equilibrium output (Ye) that is less than the full employment level of output (Yf), the economy has a recessionary gap (negative GDP gap). Since the unemployment rate will be higher than the natural rate, some workers will be cyclically unemployed.

If the government takes no action to close this recessionary gap, the economy will close that gap on its own, in the long run. Since workers (and other resources) are sitting idle during a recession, eventually those unemployed workers will accept lower wages (and other resource prices will fall). When that occurs, lower wages (and other resource prices), will mean lower costs for businesses. Those lower production costs will cause a rightward shift of the SRAS curve, bringing the economy back to long-run equilibrium, where current equilibrium output equals full employment output.

From a Short-run Inflationary Gap to Long-run Equilibrium:

The economy has an inflationary gap (positive GDP gap) whenever the current equilibrium output (Ye) is greater than the full employment level of output (Yf). When the economy has an inflationary gap, unemployment is lower than the natural rate, and many employees feel overworked.

Even without government intervention, the economy will close a recessionary gap on its own, in the long run. Since the unemployment rate is so low, businesses will have trouble finding workers to hire, and that labor shortage will lead to higher wages. Other resources prices will also rise. The higher input costs from the higher wages (and other resource prices), will cause the short-run aggregate supply curve to shift to the left until long-run equilibrium is restored.

From Long-run to Short-run and Back

While the economy moves to long-run equilibrium in the long run, it will not stay there forever. Changes is aggregate demand or aggregate supply can cause the economy to move into a recession or an inflationary gap. No matter the cause, it will be a shift of the short-run aggregate supply curve (through changes in wages and other resources prices) that brings the economy back to long-run equilibrium.

If there is an increase in consumer confidence, consumers will spend more and aggregate demand will shift to the right. That decrease in aggregate demand will cause an inflationary gap. If there is no government intervention, wages (and other input prices) will rise. That causes short-run aggregate supply to shift to the left, restoring long-run equilibrium.

If there is an adverse supply shock to the economy, like one caused by an oil crisis, the leftward shift of the aggregate demand curve will create a recessionary gap. In the long run wages (and other resource prices) will fall. That causes short-run aggregate supply to shift to the right, restoring long-run equilibrium.

In short, it doesn’t matter what caused the economy to slip into an inflationary or recessionary gap. Without government intervention, the economy will return to the full employment level of output in the long run, through a shift of the short-run aggregate supply curve, caused by changes in wages (and other resource prices).

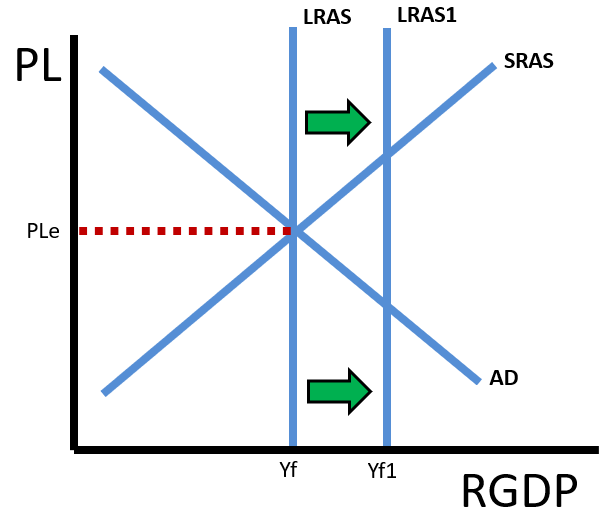

Long-run Growth

While you will learn more about economic growth in unit 5, for now you should know that changes in the quality or quantity of resources will cause a shift of the long-run aggregate supply curve (LRAS). When the LRAS shifts, the real GDP output produced with full employment (Yf) will also change. A rightward shift of LRAS increases Yf, and a leftward shift of LRAS decreases Yf.