How do fiscal policy and monetary policy interact in the short run?

Updated 8/30/2022 Jacob Reed

The following is an overview of how monetary and fiscal policy actions of the Federal Reserve and the President and Congress interact to impact the macro economy. Before you get started with this topic, make sure you have a pretty good understanding of fiscal policy tools, monetary policy tools, the AS/AD model, the Loanable Funds Market, and the Money Market. This content review covers topic 5.1 of the AP Macroeconomics Course Exam Descriptions (CED).

How do fiscal and monetary policy action combinations impact the AS/AD model?

Since monetary and fiscal policy both shift the Aggregate Demand curve in the short run, the key to figuring out how the combination will impact the price level and real output (and with output, employment), is to figure out which direction each action will shift the AD curve then reconcile the two.

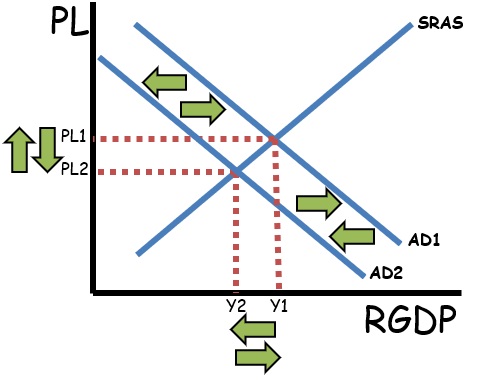

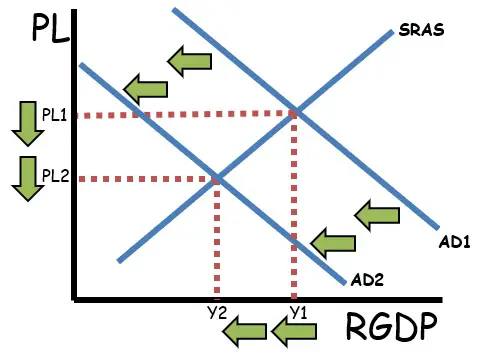

Contractionary fiscal policy and contractionary monetary policy both shift the AD curve to the left. That means the combination of actions will definitely shift the AD curve to the left; causing a decrease in the price level and decrease in real output. This combination of actions can be used to close an inflationary gap and fight inflation.

Expansionary fiscal policy and expansionary monetary policy both shift the AD curve to the right. That means the combination of actions will surely shift the AD curve to the right; causing an increase in the price level and increase in real output. This combination of actions can be used to close a recessionary gap and fight unemployment.

Contradictory fiscal policy and monetary policy actions will have an indeterminate impact on the AD curve and therefore an indeterminate impact on the price level and real output. So, if the government takes expansionary fiscal policy action (shifting AD right) while the Federal Reserve engages in contractionary monetary policy (shifting AD left), the net effect will be indeterminate (as AD shifts left and right and we won’t know which action is more powerful). If the government takes contractionary fiscal policy action (shifting AD left) while the Federal Reserve engages in expansionary monetary policy (shifting AD right), the net effect on AD (as well as the price level and real output) will again be indeterminate.

How do fiscal and monetary policy action combinations impact interest rates?

Just like the impact on the AS/AD model, the key to determining the combined impact of fiscal and monetary policy actions on interest rates is to determine each action’s impact individually first. If the impacts on interest rates are the same, that is the definite impact of the combination of actions. If the impacts are different, the combined impact will be indeterminate.

Note: Don’t forget that interest rates determine the quantity of investment. Investment is primarily purchases of physical capital, so lower interest rates increase investment and economic growth, while higher interest rates decrease investment and economic growth.

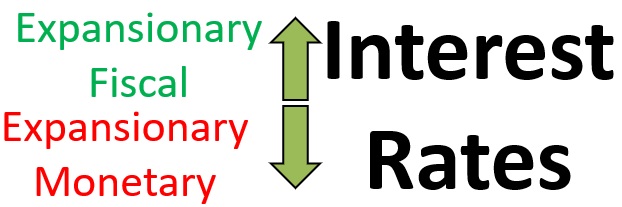

Expansionary fiscal policy increases the national deficit (and national debt) and causes crowding out. The demand for loanable funds increases (or the supply decreases), and interest rates increase.

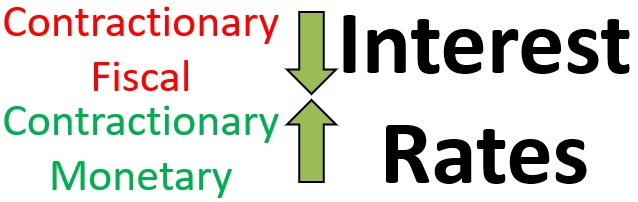

Contractionary fiscal policy decreases the national deficit. The demand for loanable funds decreases (or the supply increases), and the interest rate decreases.

Monetary policy has the opposite effect on interest rates as fiscal policy. Expansionary monetary policy decreases interest rates while contractionary monetary policy increases interest rates.

When fiscal and monetary policy are both expansionary or both contractionary, there will be an indeterminate impact on interest rates. That is because one action will increase interest rates while the other other action will decrease interest rates.

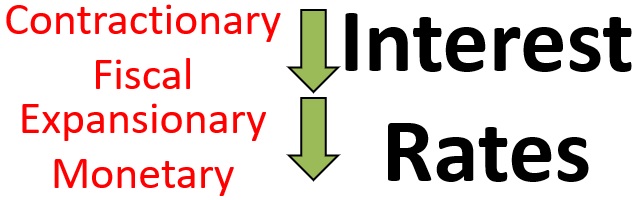

If fiscal policy is expansionary while monetary policy is contractionary, the interest rate will surely increase; since both actions serve to increase interest rates. If fiscal policy is contractionary while monetary policy is expansionary, the interest rate will surely decrease.

Note: The fisher formula indicates that nominal and real interest rates move together in the short run (since wages and prices are sticky).

Ready to practice with the interactions between monetary policy and fiscal policy? Practice now with the fiscal policy monetary policy sorting game and make sure you really get this.