The Loanable Funds Market

Updated 11/4/2021 Jacob Reed

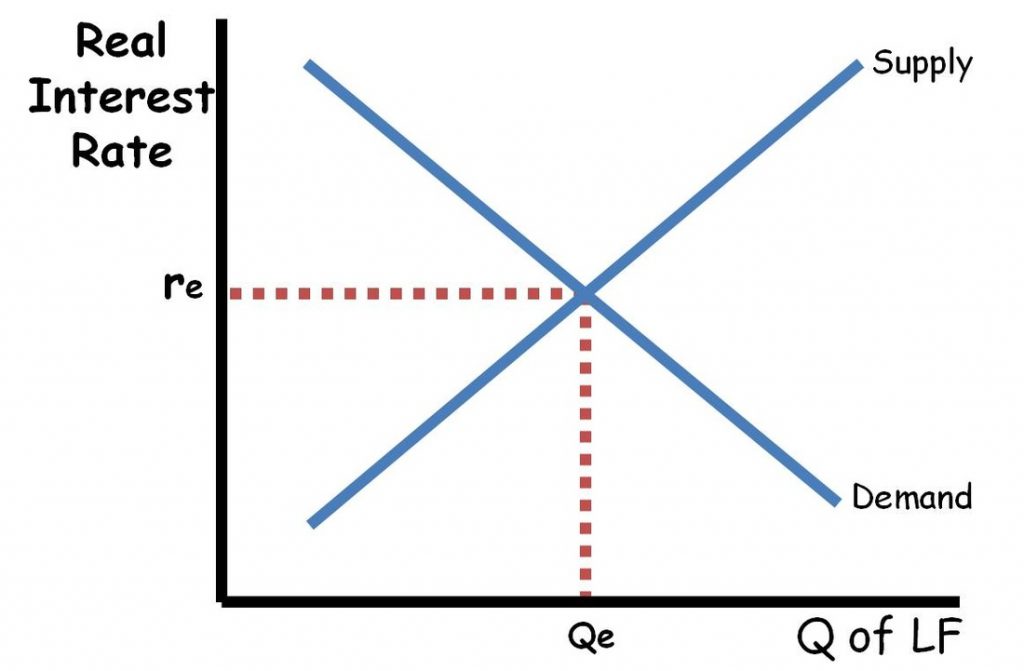

The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity. What makes this market different is the axis labels and the determinants that shift both curves. So drawing it and manipulating it isn’t too difficult if you remember a few key things.

The Y axis on a loanable funds market is the real interest rate; abbreviated with a lowercase “r”. That means it is the nominal interest rate minus inflation. It is the price for taking out a loan. The X axis is the quantity of loanable funds. The supply curve is the savings supply and the demand curve is predominantly the demand for investments.

Determinants of Loanable Funds Demand:

1. Changes in the expected rate of return on investment. This is all there is. Anything that changes the expected rate of return on investment will shift this curve. It could be changes in the economy, tax credits, and bullish or bearish feelings about the economy. Businesses demand more loanable funds when they expect to earn more on the investments they are purchasing with those loans.

Note: As mentioned below, shifting the demand or supply with changes in the government deficit or surplus is acceptable on the AP Exam. My advice is to stick with what your teacher taught you.

Determinants of Loanable Funds Supply:

1. Consumer Savings

a. changes in disposable income – more income means more savings, less income means less savings

b. anything else that causes consumers to save more or less of their income

2. Foreign investment – When foreign investors move their financial capital into a country they increase the supply of loanable funds available.

Connection to Growth:

The real interest rate is a primary force in determining economic growth. When interest rates are high, there is a decrease in the quantity of new investment (gross investment). This decreases capital formation and slows economic growth. If there is a decrease in the supply of loanable funds, interest rates rise and a decrease in economic growth will result. On the flip side, when interest rates are low, there is an increase in the quantity of investment and economic growth increases.

Fiscal policy impact on loanable funds:

Crowding out, is the idea that expansionary fiscal policy will reduce private investment and decrease long-run economic growth. Expansionary fiscal policy increases the deficit. As a result, the government must borrow more and increase its debt. That increased borrowing increases interest rates in the loanable funds market and crowds out private investment. Contractionary fiscal policy decreases the deficit and therefore decreases borrowing which causes interest rates to fall and the quantity of investment to increase. You can read more on the deficits and crowding out page.

Up Next:

Review Game: Loanable Funds Market Graph Review Activity

Graph Drawing Practice: Loanable Funds Market

Content Review Page: Fiscal Policy

Outside Resource: Phil Klein