What Is Opportunity Cost?

Updated 3/26/2024 Jacob Reed

The study of economics focuses on the problem of scarcity; resources are limited and insufficient to fulfill human wants. That scarcity forces us to make choices and those choices have costs. This review page covers this basic economic concept of opportunity cost. After you finish reviewing these concepts, test your knowledge with a 20 question review game on calculating opportunity cost, profit, revenue, and firm costs. The first 5 of those questions are specifically about opportunity cost.

Opportunity Cost

Economists like to say every choice has a cost. That cost is called an opportunity cost. In economics, cost isn’t just about money; it is about lost opportunities. For example, if you choose to go to soccer practice, you lose the opportunity to hang out with your friends. Hanging out with your friends is your opportunity cost. Opportunity cost is the value of the best alternative not chosen.

Here is another example, let’s say your friend offers to buy you lunch. You could eat a hamburger, salad, sandwich, or burrito (these are all of your alternatives). You decide to get the burrito. The burrito is your choice (the best alternative). Your opportunity cost is the second best choice available or what you would have gotten if the burrito wasn’t available. If that was the hamburger, then the hamburger is your opportunity cost for choosing the burrito.

Explicit Cost vs Implicit Cost

There are two types of cost that total the opportunity cost for a choice. Explicit cost is the cost most people think about when they hear the word cost. Explicit cost is the money paid when a choice is made. If I choose to go to the movies with my friend, the price of the ticket, popcorn, and soda would be the explicit cost of going to the movie.

Implicit cost is the value of lost opportunities (lost income most often in AP) as the result of a choice. If I took the night off work to go to the movies with my friend, the implicit cost would be the money I could have earned that night had I worked.

Opportunity cost is the explicit costs and implicit costs added together.

Calculating Opportunity Cost

Many times on an exam you will see questions that require you to calculate opportunity cost. The key to answering these questions is to focus on the cost of the choice. If someone loses the opportunity to earn money (implicit cost), that is part of the opportunity cost. If someone chooses to spend money (explicit cost), that money could be used to purchase other goods and services so the spent money is part of the opportunity cost as well. Add the value of the next best alternatives (the opportunities that would have been chosen had the choice not been available) and you have the total opportunity cost. If you miss work to go to a movie, your opportunity cost is the money you would have earned if you went to work plus the money spent to go to the movie.

Note: In economics classes, the terms opportunity cost and cost are often used interchangeably. So when you hear cost, it is the implicit and explicit costs added together.

Making Choices

A basic assumption in Microeconomics is that people are generally rational. That means people tend to act in their own best interest. As a result, people only make a particular choice when the benefits outweigh the costs. Later you will learn most decisions are made incrementally at the margin. Other decisions cannot be broken down incrementally and must be made while looking at total benefits and total costs. If the total benefit of going to the movies is larger than the total cost (implicit and explicit), a rational person would go to the movies. That means if you choose to take work off to go see the next Avengers movie, you expect going to the movie will be worth more to you than the money you pent plus income you lost.

Note: For consumers, benefit is often called utility (the satisfaction that comes from consuming a good or service) and for businesses, benefit is often called revenue (the money brought in by selling a good or service).

Opportunity cost on the Production Possibilities Curve

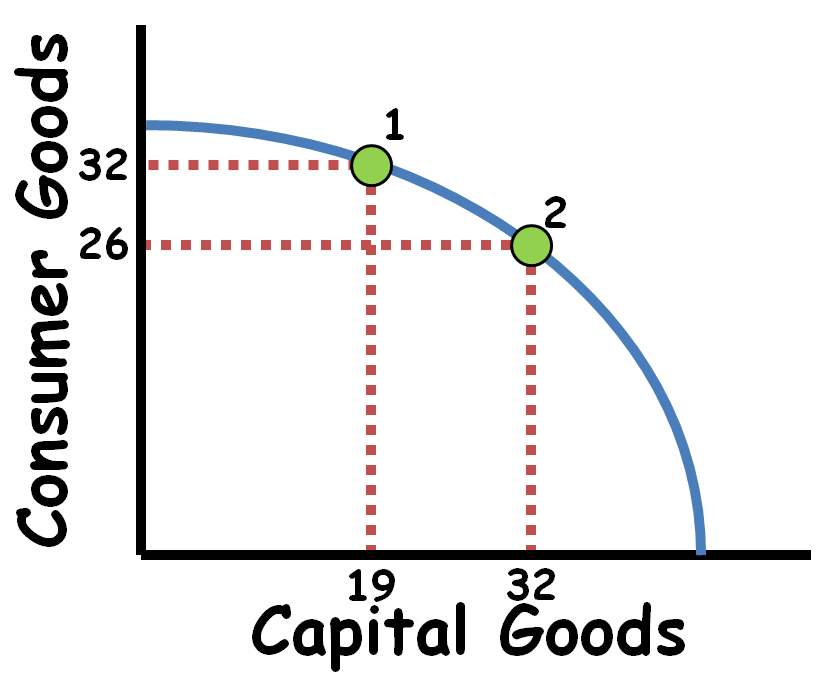

The production possibilities curve illustrates different combinations of two goods (or groups of goods) that can be produced with fixed resources. When answering questions about opportunity costs on a PPC graph, just look to the axes. Take a look at the PPC graph to the right. If this economy produces at point 2 instead of point 1, the opportunity cost of 6 additional units of consumer goods is 13 units of capital goods.

Multiple Choice Connections:

2012 Released AP Microeconomics Exam Questions: 1, 46

Up Next:

Review Game: Cost, Profit, and Revenue Flash Review

Content Review Page: Production Possibilities Curve

Other recommended resources: Paddy Hirsch Video (Opportunity Cost), Khan Academy Video (Economic Profit VS Accounting Profit)