The Business Cycle and Goals for the Economy

5/18/2020 Jacob Reed

Macroeconomics is all about 3 main goals; full employment, stable prices and growth. Unfortunately, capitalist economies have trouble achieving all three goals at all times due to something called the business cycle.

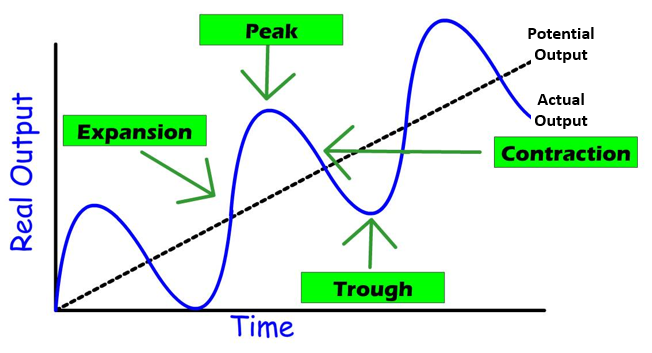

The business cycle is the natural ups and downs that come with a capitalist economy. Capitalist economies naturally rise and fall through periods of boom and bust.

What are the 3 main goals for the economy?

The main goals of the US economy are also found in the business cycle and when the government gets involved with fiscal policy or monetary policy (technically the Fed is quasi-government) it works to limit the effect of the business cycle and obtain the three macroeconomic goals. The first macroeconomic goal is full employment (4-6% unemployment). An expanding economy is likely to have more jobs and fewer workers unemployed. Unemployment tends to be lowest at the peaks and highest in the troughs. The second macroeconomic goal is stable prices (approximately 2% inflation). Inflation tends to be lowest in the troughs and highest at the peaks. The third and final goal is growth (2-3% real GDP annual increase). In AP macroeconomics growth doesn’t just mean more GDP; it means more potential GDP. So recovering from an economic downturn isn’t enough for growth. The overall trend-line should be upward sloping. True economic growth requires more resources, technology, and/or productivity.

What are the 4 stages of the business cycle?

When the economy expands, times are good and unemployment is low; but eventually the economy peaks. When the economy peaks, inflation is often high as consumers begin to purchase goods and services at a higher rate than the economy’s ability to produce. This is called an inflationary gap; actual GDP is greater than long run potential GDP. It drives up prices and results in inflation. The peak is followed by a contraction when the economy slows down and production falls below potential. If the contraction lasts more than 2 consecutive quarters (6 months) it is called a recession. The trough following a recession is the economic low point. It marks the end of the contraction and coincides with a recessionary gap; where actual GDP is less than the long-run potential. Unemployment (cyclical) is high and there could even be some deflation. When the actual GDP and potential GDP are equal, the economy is in long-run equilibrium and the unemployment rate is equal to the natural rate of unemployment (there is no cyclical unemployment).

What indications of the business cycle are there?

Leading indicators anticipate what direction the economy is heading in the future. They aren’t always accurate, but their predictive power makes them useful. The leading indicator most seen on the AP Macroeconomics exam is business inventories. Business inventories are the products that have been made, but not yet sold. A dramatic, unexpected increase in inventories is often a leading indicator of an impending economic downturn. That is because businesses are not selling all that is being produced and are likely to decrease production and employment moving forward.

Lagging indicators may be more accurate than leading indicators, but they only tell us where the economy was in the past. Gross Domestic Product, the unemployment rate, and the CPI inflation rate are the most common lagging indicators. They provide valuable information, but don’t give us good clues regarding where the economy is headed next.

Up Next:

Review Game: Business Cycle Activity

Content Review Page: Gross Domestic Product