Circular Flow Model

Updated 10/12/2020 Jacob Reed

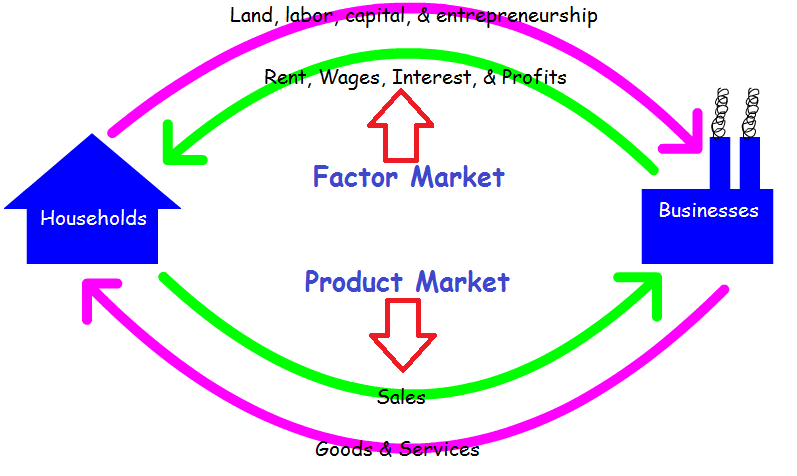

The circular flow model illustrates the flows of money, resources, and products throughout an economy. It’s not overly complicated, but there are some key things you should know about it. For those who are reviewing this for an AP class or exam, this most often shows up as multiple choice questions. There have been no released FRQ questions about it yet.

Circular flow diagrams can get quite detailed and extensive. Since this site is focused on the introductory Microeconomics and Macroeconomics, only a simplified circular flow diagram is discussed below. When you finish reading this overview, make sure you check out the 20 question Circular Flow Model review activity to check your understanding of this relatively straightforward economic model.

The Markets

The circular flow diagram contains two distinct markets. The first is the Product Market. In the product market, goods and services are exchanged for money. In the product market, businesses are suppliers and households (consumers) are demanders.

The second market in the circular flow diagram is the Factor Market (also called resource market). There, factors of production are exchanged for money. In this market, households are the suppliers and businesses are demanders.

The Economic Actors

In the simplified circular flow diagram, there are just two economics actors: businesses and households. More detailed circular flow diagrams include the government, foreign markets, banking systems, etc., but that is more detail than you generally need to know for an introductory course.

Households are the owners of resources in the circular flow model. Those resources include land, labor, capital, and entrepreneurship. Households exchange resources for monetary payments. The payments for land are generally called rent; payments for labor are called wages. Payments for capital are referred to as interest. That is because physical capital is often financed through loans requiring interest payments. Payment for entrepreneurial talent is called profit. When a business makes a profit, that money goes to the owner of the business to pay for his or her entrepreneurship.

Businesses are the producers of goods and services in the circular flow model. They purchase resources in the factor market and sell goods and services in the product market. The monetary payments in the product market are generally called sales.

Flows

The money flow includes all payments within the circular flow model. Money flows from businesses to households, then back to businesses. Money facilitates the exchange of products and resources. Since economics isn’t really about money, some might say the money flow is not as important as the real flow.

The real flow is what economics is all about. It includes resources (land, labor, capital, and entrepreneurship) as well as products (goods and services). Resources flow from households to businesses and products flow from businesses to households.

Leakages and Injections

A leakage from the circular flow model occurs any time money leaves the economy. If you purchase a foreign made product (import) or you save your money, it is no longer part of the circular flow. Those are leakages.

An injection occurs any time money enters the economy. If citizens in other countries purchase US Goods, or businesses borrow then spend money from banks (funded by people’s savings), the money flow increases. Those are injections.

Note: This is a simplified free market circular flow model. In capitalist economies, the government is another economic actor. The government buys labor in the resource market and buys products in the product market.

Up Next:

Review Game: Circular Flow Review Activity

Content Review Page: Business Cycle

Other recommended resource: ACDC Video